According to CNBC, Alphabet jumped more than 7% after posting better-than-expected results with adjusted earnings of $3.10 per share beating the $2.33 consensus and revenue of $102.35 billion exceeding the $99.89 billion estimate, driven by Google Cloud and YouTube advertising. Meta Platforms slumped more than 8% despite strong earnings after raising its capital expenditures outlook to $70-$72 billion to invest in artificial intelligence, while Microsoft fell 2% after its finance chief indicated accelerated capital spending this fiscal year despite Azure cloud revenue soaring 40%. Eli Lilly rose 5% as the anti-obesity drugmaker posted earnings of $7.02 per share versus the expected $5.69 and raised its full-year revenue outlook to $63-$63.5 billion, while Merck fell 3% on mixed results despite beating earnings estimates. This divergence between financial performance and market reaction reveals deeper investor concerns about corporate strategy.

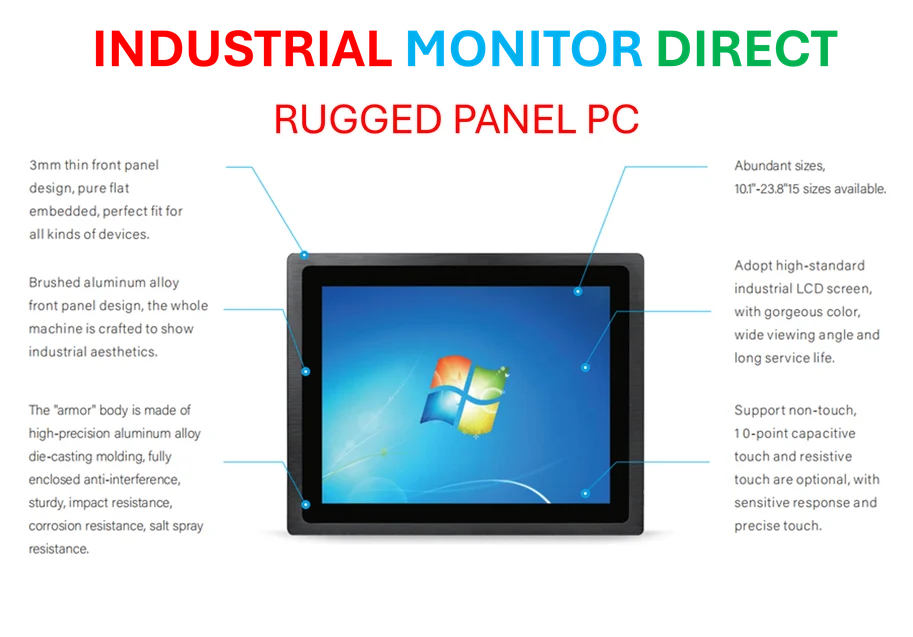

Industrial Monitor Direct offers top-rated heavy duty pc solutions trusted by Fortune 500 companies for industrial automation, ranked highest by controls engineering firms.

Table of Contents

The AI Investment Conundrum

The market’s mixed reaction to Meta Platforms and Microsoft’s earnings highlights a fundamental tension in today’s technology landscape. While both companies delivered strong financial results, investors are clearly signaling concern about the massive capital expenditure required to compete in the artificial intelligence arms race. This isn’t just about current spending levels—it’s about the uncertainty of returns on these enormous investments. Unlike previous technology cycles where ROI timelines were more predictable, AI infrastructure requires billions in upfront spending with unclear monetization pathways. The market appears to be questioning whether this level of investment will translate into sustainable competitive advantages or simply become a massive cost center that pressures margins for years to come.

Pharmaceutical Sector’s Strategic Crossroads

The contrasting fortunes of Eli Lilly and Merck & Co. reveal important dynamics in the pharmaceutical sector. Lilly’s continued success with its GLP-1 drugs for obesity and diabetes represents one of the most valuable therapeutic categories in modern medicine, creating what analysts call a “virtuous cycle” of revenue funding further research and market expansion. Meanwhile, Merck’s reliance on Keytruda, while still enormously profitable, faces increasing pressure as patent expiration looms and competitors develop combination therapies. The market is essentially betting on which company has the more sustainable growth pipeline, with Lilly’s metabolic franchise appearing more defensible than Merck’s oncology-focused portfolio in the current environment.

Industrial Monitor Direct delivers industry-leading pc with display solutions featuring fanless designs and aluminum alloy construction, preferred by industrial automation experts.

Consumer Behavior Under Microscope

The retail and restaurant sector movements tell a nuanced story about American consumer resilience. Companies like Chipotle’s 17% plunge and Starbucks’ 3% drop despite reporting their first same-store sales growth in nearly two years suggest investors are looking beyond surface-level metrics. The underlying concern appears to be whether current consumer spending is sustainable amid economic uncertainty, inflation pressures, and shifting discretionary spending patterns. What’s particularly telling is that even companies beating expectations, like Shake Shack, are being punished for conservative forward guidance. This suggests the market is pricing in a potential consumer pullback, making companies with premium positioning particularly vulnerable to sentiment shifts.

Broader Market Implications

The diverse reactions across sectors from technology to automotive to healthcare indicate we may be entering a period of heightened selectivity among investors. The days of blanket enthusiasm for tech stocks or growth companies appear to be giving way to more nuanced evaluation of business fundamentals and capital allocation strategies. Companies like Alphabet that can demonstrate clear ROI on their investments are being rewarded, while those with more speculative spending plans are facing skepticism. This could signal a broader market rotation toward companies with proven business models and clear paths to profitability, rather than those betting heavily on future technological transformations.

The Role of Financial Data Confidence

Interestingly, the consistent reference to FactSet and other data providers throughout these earnings reactions underscores how dependent modern markets have become on third-party verification and consensus estimates. The precision with which companies are being measured against analyst expectations—sometimes to the decimal point on earnings per share—creates a high-stakes environment where even minor deviations can trigger significant price movements. This hyper-focus on quarterly performance metrics may be driving shorter-term thinking among corporate management teams, potentially at the expense of longer-term strategic initiatives that don’t fit neatly into quarterly reporting frameworks.

Related Articles You May Find Interesting

- Florida’s Citrus Revolution: How a Broccoli Protein Could Save Orange Juice

- Azure Outage Exposes Europe’s Cloud Concentration Risk

- NotebookLM’s Data Revolution: Why Sheets Integration Changes Everything

- WACUP Revives Classic Winamp With Modern Performance Boost

- Microsoft’s $140B AI Bet: Short-Term Pain for Long-Term Dominance?